How To Cash Out Your Bitcoin

This articlewas originally published at Mintdice.com on June 13, 2019. It is being republished here with the publisher’s permission through syndication.

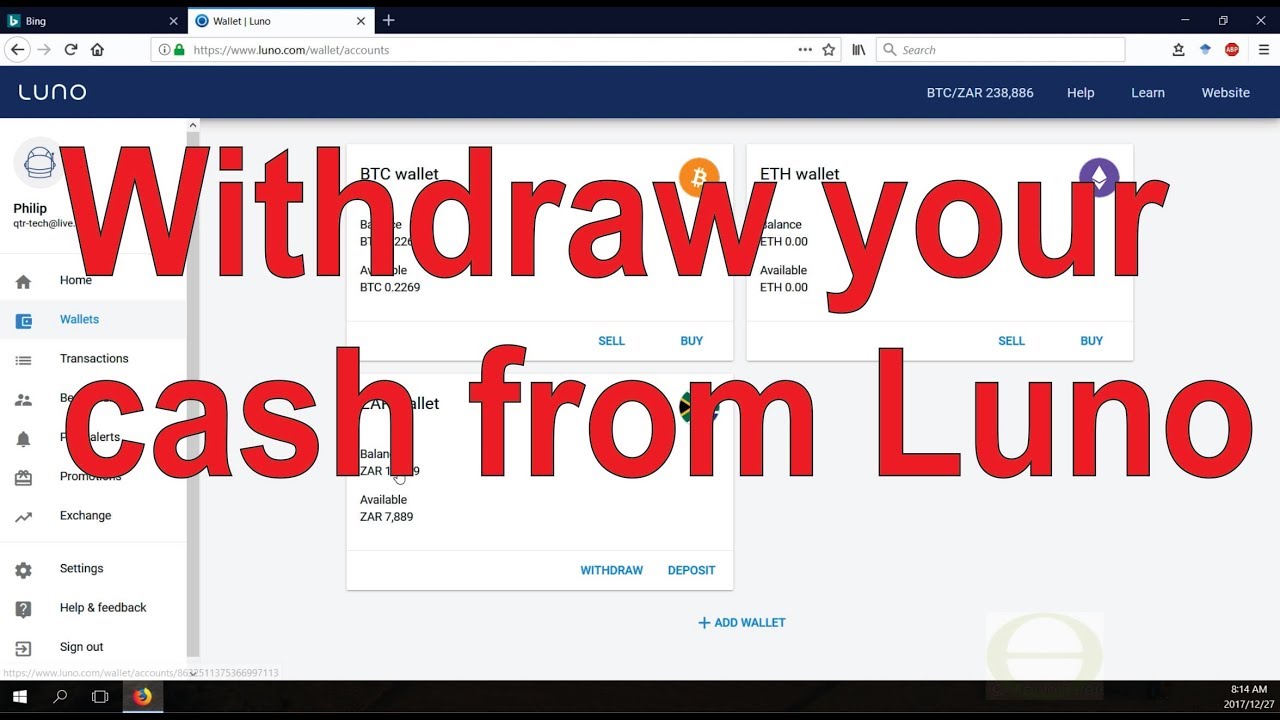

- How To Withdraw Your Bitcoin Cash

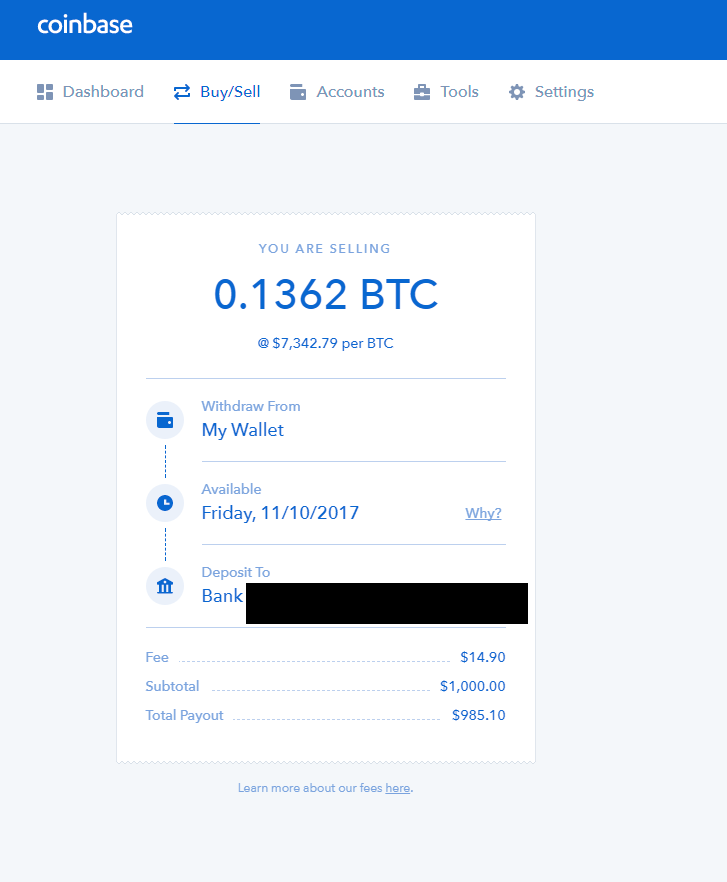

- How To Withdraw Your Bitcoin From Coinbase

- Cash Out Bitcoins To Bank Account

- How Do You Cash In Your Bitcoin

- How Do I Cash Bitcoin

Although it’s safe to say that Bitcoin is a lot more popular today than it was even one year ago, it hasn’t reached a significant level of adoption compared to fiat money. Even though several products and blockchain projects have been built around it, Bitcoin has continuously shown that it cannot be used as a stable form of money.

This has led to regulatory problems, issues with banks, and ultimately, lack of acceptance by businesses. What good is money if it can’t be spent on the simplest exchanges of goods and services? As a result, it’s quite common to convert Bitcoin assets into fiat currency to be used for purchasing items.

Bitcoin has also proven that it can be a great trade and investment vehicle, but it also can be a terrible one. So if a user holds Bitcoin and there’s an impending decline in the market, it’s reasonable to liquidate BTC by converting it to cash.

WHAT ARE THE MAIN METHODS OF CASHING OUT BITCOIN?

There are several ways to convert bitcoin to cash and ultimately move it to a bank account: Sell bitcoin on a cryptocurrency exchange, such as Coinbase or Kraken. This is the easiest method if you want to sell bitcoin and withdraw the resulting cash directly to a bank account. Leave your Country and cash out Bitcoin abroad. One option is to leave your country permanently and cash out your Bitcoin in another country afterwards. If Bitcoin has made you rich, this can be a realistic option. In principle, it’s possible to live as a nomad without fixed residency, as an earth resident so to say.

There are four main methods of cashing out Bitcoin for fiat currency. They include peer-to-peer exchange, third-party broker exchange, Bitcoin ATM, or bitcoin debit card.

1. PEER-TO-PEER EXCHANGE

Peer-to-peer exchanges connect Bitcoin users and match them according to their buy and sell orders so that they can carry out the exchange by themselves. For example, if Person A is looking to sell Bitcoin at $7,000 per unit and person B is looking to buy some at a similar price, the exchange matches them and they carry out the transaction without the interference of the exchange.

Cashing out Bitcoin via a peer-to-peer exchange is great for users who want to avoid the prices set by centralized exchanges. It also helps them avoid the charges and long waiting time that accompanies cashing out with broker exchanges.

There are three ways to accept cash on a P2P exchange: through a cash deposit, bank transfer or in-person. Cash deposits and bank transfers are generally safe but it is advisable to request a proof of identity to avoid fraud. Arranging a meet-up is a great option because there’s no need for an escrow.

HOW TO CASH OUT BITCOIN ON A PEER-TO-PEER EXCHANGE

- Register on a P2P exchange and set a price to sell Bitcoin

- Wait for the exchange to match a buyer

- Contact the buyer and make arrangements for payment through a cash deposit, bank transfer or physical cash

- Put the Bitcoins in escrow until the payment is received

- Release the Bitcoins to the buyer

Pros

- It is fast compared to a third-party broker exchange

- It has fewer charges

- It gives users total control over who they transact with

Cons

- It is less secure than a centralized broker exchange.

Some existing peer-to-peer exchanges include Paxful and Localcoinswap, which have no charges, and Localbitcoins, which has a trading fee of 1%.

2. THIRD-PARTY BROKER EXCHANGE

Third-party broker exchanges, or centralized cryptocurrency exchanges as they are commonly called, handle the entire exchange of Bitcoin for cash. For example, on a platform like Binance or Coinbase, a user can enter a buy request and be automatically matched to another sell order. The exchange handles the sale itself with additional charges as part of the service.

This method is ideal for anyone who would rather not deal with others when buying or selling. The exchange is also liable in the event of theft or fraud that occurs on their platform. So if a user’s Bitcoin exchange account is compromised, their funds will most likely be replaced. It is also the best option for those who want to withdraw cash directly to their accounts after a Bitcoin exchange.

HOW TO CASH OUT BITCOIN USING A THIRD-PARTY BROKER EXCHANGE

- Research the best exchanges and choose the best one based on a personal set of requirements

- Register for an exchange account

- Deposit Bitcoin into the exchange account wallet

- Place a sell order

Pros

- It is more secure and less stressful than peer-to-peer exchanges

Cons

- Exchanges have more control over user funds

- Slow withdrawal times. For example, a cash withdrawal on Coinbase takes anywhere between 1 and 5 days to complete.

How To Withdraw Your Bitcoin Cash

Some good third-party exchanges are Kraken, Binance, Coinbase, Bitfinnex, and Poloniex.

3. BITCOIN ATM

A Bitcoin ATM allows anyone to buy or sell bitcoin using a credit card or cash. It looks just like a regular ATM, except that it isn’t tied to a bank account. Currently, there are more than 2000 Bitcoin ATMs spread around the world. This is a good way to cash out without dealing with stress from Bitcoin exchanges.

It is straightforward and secure, and allows a person to withdraw cash or Bitcoin without dealing with another party. Bitcoin ATMs vary by operation and some available types include Genesis1 Bitcoin ATM, Satoshi1 Bitcoin ATM, Lamassu Bitcoin ATM, and BitAccess Bitcoin ATM.

HOW TO CASH OUT USING A BITCOIN ATM

- First, locate the nearest Bitcoin ATM by visiting Coinatmradar, a site that shows a live map of functional BTC ATMs

- On the ATM, choose the cash withdrawal option

- When asked for a currency choice, pick Bitcoin

- Choose the withdrawal amount

- Send BTC from a mobile wallet to the QR code provided by the ATM.

- Collect cash

Pros

- It is secure

- The process of using a Bitcoin ATM is more straightforward than using an exchange

- No registration needed

Cons

- Bitcoin ATMs are static and cannot be used without being physically at the machine

- They are not common, especially in developing countries

Bitcoin ATMs are usually found inside restaurants, shops, retail stores, airports, or malls.

4. BITCOIN DEBIT CARD

A Bitcoin debit card allows a user to withdraw cash instantly even when it’s loaded with Bitcoin. One great example is the CEX.io debit card, which is linked to the CEX.io exchange. This a good way to cash out Bitcoins when there are more traditional ATMs than Bitcoin ATMs around.

HOW TO USE A BITCOIN DEBIT CARD

- Search for crypto debit card providers like Uquid

- Register for a debit card

- Add the card to the preferred exchange wallet

- Either sell Bitcoin on the exchange and withdraw the cash to the debit card or send Bitcoin directly to it

- Withdraw cash using the card at a normal ATM

Pros

- It is a better option than Bitcoin ATMs for developing countries

- Most card providers offer instant withdrawal

Cons

- Fees can be as high as $3 per withdrawal

- An Exchange account is needed most times

Some of the best Bitcoin debit card providers include Wirex, Cryptopay, Bitpay, and Uquid.

FINAL THOUGHTS

When dealing with Bitcoin, users will need to cash out at some point. Whether due to a fall in price, the need to convert crypto investments into traditional ones, or just the need to spend cash instead of BTC, the need always arises.

Centralized cryptocurrency exchanges are currently the most common way to convert any cryptocurrency to cash. In fact, they are usually the starting point for beginners. They have significantly less risk than P2P exchanges and are also easier to use. Bitcoin ATMs and debit cards are not as common but are also easy, safe ways to cash out Bitcoin.

It’s important to weigh the pros and cons of each before choosing any of these options. Ultimately, they have the same outcome but depending on a user’s location, and other preferences, they are all drastically different.

More on this topic: BUYING BITCOIN WITH PAYPAL: HARDER THAN IT SOUNDS

Although it’s getting easier by the day, selling bitcoin is still marginally more difficult than it is to buy. As such, we’ve put together this guide to help you navigate the process. The first step you’ll need to take is deciding upon which method you’d like to use: selling bitcoin online or selling bitcoin in person.

We’ll break down the pros and cons of both approaches.

This is hands down the most popular way of trading your bitcoin for fiat.

There are three main options for doing so online namely direct, via an exchange or peer-to-peer (P2P).

1. Direct

This is when you trade your bitcoin for fiat directly with another person, with an online company in the middle brokering the trade.

- Websites that offer this service include:

- Coinbaseand LocalBitcoins in the US

- BitBargain and Bittylicious in the UK

- These sites typically require registration as a seller which involves verifying your identity with official documents like your passport/driver’s licence.

2. Exchange

If you’re not already registered with an exchange, doing so will give you another way of selling you bitcoin.

Exchanges act as the third party in transactions, holding the funds of buyers and sellers (for a small transaction commission, of course). To sell, you place a sell order, state the amount you want to sell, which currency you want to sell and how much you’re willing to let it go for.

Once the exchange matches your price with a price a buyer’s willing to pay, they transfer the money and the coins from buyer to seller and vice versa.

After the currency is credited to your account, the next step, is withdrawing these funds to your bank account. If there’s a liquidity issue on the exchange or an issue with their banks, this process can take a worryingly long time.

Make sure you do your due diligence on exchanges to make sure they’re of high repute and don’t have a history of withdrawal problems. Google and Reddit are your friends here.

- Exchanges you can try are:

- Binance, Kraken, Gemini and GDAX

- Identity verification is still required, but they do a lot of the sales legwork for you. To move a sizeable amount of crypto or cash, you may have to do a series of higher level verification tasks

- Keep an eye out for withdrawal fees, they can differ quite substantially and if you’re transferring large enough amounts of currency can really add up!

3. Peer-to-Peer (P2P)

A fairly new advance in the space are sites like Purse, which bring people with certain needs that the other can meet, together.

This is usually people who want to use bitcoin to buy goods from sites that don’t accept cryptocurrencies yet, and people who want to buy bitcoin with a credit/debit card.

Purse brings these two groups together and allows them to sell bitcoin to one and give discounted goods to the other. Pretty cool.

A bit like eBay, the marketplace is the middleman that provides the platform, transaction escrow and a bitcoin wallet.

Example transaction:

- Aaron posts his Amazon wish list on the Purse, stating the discount he’d like (usually this goes up to 25%).

- Mindy has a credit/debit card and wants to buy bitcoin matching the value of Aaron’s purchase(s). She agrees to the trade then buys the Amazon goods for him via the marketplace. She then requests they be delivered to Aaron’s home address.

- Upon receipt of his goodies, Aaron updates his Purse account to say he got them and Mindy’s bitcoin are released from escrow and arrive in her wallet, less Aaron’s agreed discount and a transaction fee for Purse.

Withdrawal Concerns?

How To Withdraw Your Bitcoin From Coinbase

Like most places in the world, more or less all bitcoin markets support international wire transfers.

Another popular way to move money to your bank after a sale is with the SEPA (Single European Payments Area) system. This system was designed to speed up transfers between EU member states, and exchanges like Kraken and Coinbase support them.

Despite the goal being to speed up transfers, SEPA transfers are still painfully slow and often times expensive (a perfect example of bitcoin’s reason for existence). At the time of writing, fees can range from £4 to as much as £25 per transaction depending on the bank!

Another point worth mentioning is that some banks have “Bitcoin bias” and may flat out refuse to let you receive funds from bitcoin trading altogether. I wonder why? It’s not like cryptocurrencies might be a threat to their entire business model, or anything…

If you’re looking to trade on a regular basis or withdraw large amounts of money, you might want to try using online bank Revolut. They all free bank transfers in 26 currencies and incredible currency conversion rates – about as cheap as you can possibly find them. All of this goodness is packed into an amazingly slick little free mobile app.

Who Are You?

As mentioned earlier, some bitcoin markets require you to perform varying levels of identity verification.

In most cases they’re performing the legal stipulations of their home nation to record who their users are (KYC – Know Your Client), but many are just playing it safe and collecting identifying data ahead of a time where regulation may become standard.

The selling process is usually the side of the transaction that requires the most proof, so we recommended that you set up your identity verification when you first register with a service so that in case you want to sell in a hurry, you’re not waiting around.

What might they ask from you?

Well, it ranges from scans of utility bills plus a photo ID (passport/driver’s license) up to some places asking for a selfie with you holding your photo ID and name of their service on a sheet of paper!

Cash Out Bitcoins To Bank Account

If this bothers you, then you may have a difficult time finding places to sell online

Selling Offline

4. Face to Face

How Do You Cash In Your Bitcoin

Selling a digital currency in person.

While the idea seems almost counterintuitive, it’s probably one of the easiest ways to pass your bitcoin on: all it takes is scanning a QR code on the other person’s phone and collecting cash in return.

If one of your friends or family members wants to get involved with bitcoin, simply set them up with a wallet and send them your bitcoin in return for their cash.

In order to avoid arguments, it’s a good idea to decide on a rate which you both agree on ahead of time. Other things you might want to take into consideration are:

- Checking bitcoin’s current price (you can literally just Google “bitcoin price” to find out)

- If you’re selling, maybe consider adding a little buffer percentage on those rates to cover costs and as a convenience premium

- Use a mobile app like Blockfolio, Coinbase or Zeroblock to land on the current price

- Be aware of price fluctuations in your local area. The price of bitcoin in Venezuela might not be the same as the price in the UK for example, possibly because of differences in ease of obtaining bitcoin with your country’s fiat

- Bitcoin meetups are becoming more and more frequent across the world. These meetups are not just a great place to learn, build your network and have fun, but also good places to find people looking to trade cryptos.

- Stay safe! If you’re doing a large transaction, it might be a good idea to take a friend or do so in a public place

A Word on LocalBitcoins

LocalBitcoins is the leading site for facilitating peer-to-peer bitcoin trades. Here, you can advertise yourself as a seller and find a wide range of potential buyers in places near you.

While they don’t have a lengthy verification process to go through to make sure everyone is on the up and up, the beauty of this site is the user feedback rating system which provides you with a level of comfort in knowing that the other party in your transaction is legit. As your reputation builds on the site, you can sell your bitcoin for more of a premium.

How Do I Cash Bitcoin

You can settle the transactions either in person or via their escrow service – which obviously, is the online option.